Most crypto exchange today are websites that allow users to trade cryptocurrencies such as Bitcoin and Ether for other coins or fiat currency. Binance, Huobi, Kraken, OKEx, Bitfinex, Bitstamp, Coinrail, and Bithumb are the most prominent digital crypto exchanges. Like Binance, Bitfinex, and Huobi, the first few enable users to trade BTC/ETH and convert it into and out of fiat money.

Users can, however, trade assets on Binance, Huobi, OKEx, and Bitstamp. EOS, Ripple, Gnosis, Zcash, Bitcoin Cash, Ethereum Classic, and NEM are among the cryptocurrencies available on the exchange. There are more than a few digital currencies on the market but only invest in the finest based on your demands and profit ratio.

Table of Contents

What is Crypto Exchanges?

A crypto exchange is an online platform where people buy, sell, and trade cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and other digital assets.

Think of it like a stock market, but instead of shares, you trade cryptocurrencies.

How Crypto Exchanges Work

- User signs up and completes verification (KYC)

- Deposits money (INR, USD, or crypto)

- Places a buy/sell order at market price or a chosen price

- Exchange matches orders between buyers and sellers

- Crypto is stored in your exchange wallet or transferred to a private wallet

Types of Crypto Exchanges

| Type | Description | Example |

| Centralized Exchange (CEX) | Managed by a company; easy to use | Binance, Coinbase |

| Decentralized Exchange (DEX) | No middleman; peer-to-peer trading | Uniswap, PancakeSwap |

| Hybrid Exchange | Mix of CEX & DEX features | Some modern platforms |

Key Features of Crypto Exchanges

- Real-time price charts 📊

- Multiple cryptocurrencies

- Trading tools (spot, futures, margin)

- Wallet services

- Security features (2FA, cold storage)

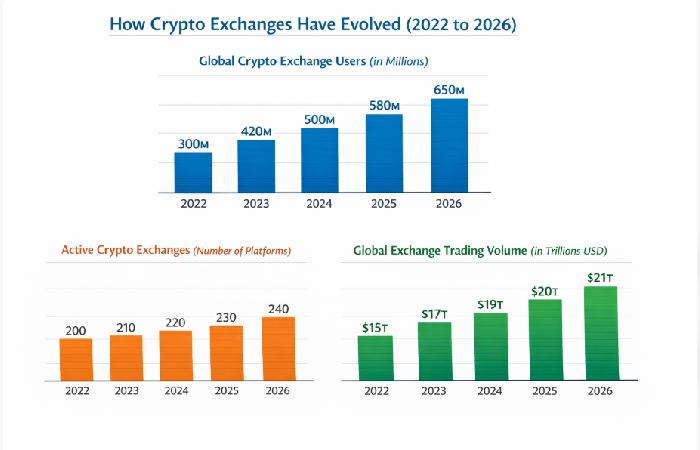

How Crypto Exchanges Have Evolved Since 2022 to 2026

From 2022 to 2026, crypto exchanges have gone through one of the biggest transformations in the history of digital finance. What started as a largely unregulated, growth-at-all-costs industry has matured into a more secure, compliant, and user-focused ecosystem.

Global Crypto Exchange Users (in Millions)

| Year | Users (M) | Bar Graph |

| 2022 | 300M | █████████ |

| 2023 | 420M | ██████████████ |

| 2024 | 500M | █████████████████ |

| 2025 | 580M | ████████████████████ |

| 2026 | 650M | █████████████████████ |

Trend: The number of people using crypto exchanges keeps rising each year as adoption spreads globally — from ~300 M in 2022 to an estimated ~650 M in 2026.

Active Crypto Exchanges (Listings / Platforms)

| Year | Active Exchanges | Bar Graph |

| 2022 | 200 | ███████ |

| 2023 | 210 | ████████ |

| 2024 | 220 | █████████ |

| 2025 | 230 | ██████████ |

| 2026 | 240 | ███████████ |

Insight: The number of active exchanges grows steadily as more platforms launch, even with some becoming more regulated.

Global Exchange Trading Volume (Spot + Derivatives in Trillions USD)

| Year | Volume (Trillions) | Bar Graph |

| 2022 | $15T | █████████ |

| 2023 | $17T | ██████████ |

| 2024 | $19T | ███████████ |

| 2025 | $20T | ████████████ |

| 2026 | $21T | █████████████ |

Meaning: Trading volume continues to climb year over year, reflecting growing market activity — though it can fluctuate month to month.

How Regulation Shapes Your Exchange Options

Regulation plays a critical role in determining which exchanges you can use, how safe your funds are, and what features are available to you. Whether you are dealing with crypto exchanges, stock trading platforms, or commodity exchanges, regulatory frameworks directly influence your overall experience as a user.

| Regulation Aspect | Highly Regulated Exchanges | Lightly / Unregulated Exchanges |

| User Safety | Strong consumer protection and legal safeguards | Limited or no user protection |

| KYC & AML | Mandatory identity verification | Often minimal or optional |

| Risk of Fraud | Low to moderate | High |

| Product Availability | Restricted leverage and products | Wider, riskier product options |

| Legal Recourse | Available through authorities | Very limited or none |

| It | High | Uncerta |

In short, regulation shapes not just where you can trade, but how safely and responsibly you can do so.

Top Cryptocurrency Exchanges by Trading Volume (Estimated)

| Rank | Exchange | Estimated 24h Trading Volume | Key Notes / Strengths |

| 1 | Binance | ~$21.4 B | Largest worldwide by volume; deep liquidity and many trading pairs. |

| 2 | Hotcoin | ~$7.9 B | Rapidly growing platform with significant daily activity. |

| 3 | Pionex | ~$6.4 B | Trading bots and automation tools popular with retail traders. |

| 4 | Azbit | ~$5.4 B | Emerging global exchange with growing user base. |

| 5 | Toobit | ~$4.6 B | Competing exchange with strong altcoin support. |

| 6 | CoinW | ~$4.6 B | Broad crypto selection and competitive fees. |

| 7 | Coinstore | ~$4.3 B | Focus on high-speed execution and regional markets. |

| 8 | KuCoin | ~$4.1 B | Well-known global exchange with many tokens and features. |

| 9 | LBank | ~$4.1 B | Strong volume from Asian markets. |

| 10 | Bybit | ~$3.9 B | Major derivatives and spot trading platform. |

Best Crypto Exchange Apps (Country-wise)

India – Best Crypto Exchange Apps

| Exchange/App | Key Features | Why It’s Popular in India |

| Binance | Huge variety of coins, low fees, mobile app | Widely adopted with deep liquidity |

| CoinDCX | Fiat on-ramp, educational tools, secure | Designed for Indian market with local KYC & support |

| CoinSwitch | Aggregates global exchanges in one app | Easy UI; Pro mode for advanced traders |

| ZebPay | Instant buy/sell, local deposits | User-friendly for beginners |

United States – Best Crypto Exchange Apps

| Exchange/App | Key Features | Why It’s Popular in USA |

| Coinbase | Regulated in US, beginner-friendly | Largest US-based exchange with strong compliance |

| Kraken | Wide selection of tokens & low fees | Trusted veteran exchange with advanced tools |

| Gemini | Strong regulatory oversight | Focus on security and compliance |

| Crypto.com | Offers crypto + card + DeFi features | All-in-one app experience |

United Kingdom – Best Crypto Exchange Apps

| Exchange/App | Key Features | Why It’s Popular in UK |

| Kraken | FCA-regulated, advanced options | Strong presence and UK compliance |

| Binance UK / Binance | Low fees, many trading pairs | Popular but with regulatory checks |

| Coinbase | Easy UI & broad crypto support | Trusted by UK users |

| Bitstamp | Long-running exchange with fiat support | Simple & reliable platform |

Nigeria – Best Crypto Exchange Apps

| Exchange/App | Key Features | Why It’s Popular in Nigeria |

| Binance | Spot, futures, staking | One of the most widely used worldwide |

| Bybit | Derivatives, advanced charts | Advanced features for active traders |

| Coinbase | Beginner-friendly | Trusted global brand |

| Quidax | Local deposit/withdrawals in NGN | Tailored for Nigerian users |

| Luno | Easy buy/sell & education | Great for crypto newcomers |

Brazil – Best Crypto Exchange Apps

| Exchange/App | Key Features | Why It’s Popular in Brazil |

| Binance | Large coin list, low fees | Very popular; high liquidity |

| Mercado Bitcoin | Local Brazilian exchange | Strong fiat on-ramp & local support |

| Foxbit | Easy trading UI | Trusted local platform |

| Crypto.com | Global app with many features | All-in-one crypto platform |

Japan – Best Crypto Exchange Apps

| Exchange/App | Key Features | Why It’s Popular in Japan |

| bitFlyer | Largest Japanese exchange | Local regulation & strong security |

| Coincheck | Simple app & wallet | Widely used by retail traders |

| GMO Coin | Part of financial services group | Trusted financial-backed exchange |

| Binance | Large global liquidity | Offers more trading pairs than local apps |

Australia – Best Crypto Exchange Apps

| Exchange/App | Key Features | Why It’s Popular in Australia |

| CoinJar | Long-standing Australian exchange | Local fiat support & simplicity |

| Binance | Wide coin support & liquidity | Global flexibility |

| Kraken | Advanced trading options | Also supports AUD |

| Crypto.com | Crypto + fintech features | All-in-one app |

Canada – Best Crypto Exchange Apps

| Exchange/App | Key Features | Why It’s Popular in Canada |

| Bitbuy | Regulated Canadian exchange | Managed local fiat & compliance |

| Newton | Low-fee trading | Simple buy/sell app |

| Kraken | Broad crypto selection | Supports Canadian residents |

| Binance | Many crypto options | Global liquidity |

Crypto Exchange Companies

| Company / Exchange | Founded | Headquarters / Origin | Type | Key Strengths |

| Binance | 2017 | Global (originally China) | Centralized (CEX) | World’s highest trading volume, low fees, many coins |

| Coinbase | 2012 | USA | Centralized (CEX) | Highly regulated, beginner-friendly |

| Kraken | 2011 | USA | Centralized (CEX) | Strong security, advanced trading tools |

| OKX | 2017 | Seychelles | Centralized (CEX) | Spot + derivatives + Web3 features |

| Bybit | 2018 | Dubai | Centralized (CEX) | Popular for futures and derivatives trading |

| KuCoin | 2017 | Seychelles | Centralized (CEX) | Wide altcoin selection |

| Bitfinex | 2012 | Hong Kong | Centralized (CEX) | High liquidity, professional traders |

| Crypto.com | 2016 | Singapore | Centralized (CEX) | App, card, staking, ecosystem |

| Gemini | 2014 | USA | Centralized (CEX) | Regulation-focused, strong compliance |

| Bitstamp | 2011 | Luxembourg | Centralized (CEX) | One of the oldest and most trusted exchanges |

| Uniswap | 2018 | USA | Decentralized (DEX) | Largest Ethereum-based DEX |

| PancakeSwap | 2020 | BNB Chain | Decentralized (DEX) | Low fees, DeFi features |

| dYdX | 2017 | USA | Decentralized (DEX) | Advanced decentralized derivatives |

| CoinDCX | 2018 | India | Centralized (CEX) | India-focused fiat support |

| WazirX | 2018 | India | Centralized (CEX) | Popular Indian exchange (spot trading) |

Conclusion

Most cryptocurrency exchanges, but not all, are appropriate for use as a trading platform. Every bitcoin exchange has advantages and disadvantages, and only a fully formed discussion can provide a comprehensive image of its trade with it. However, being a newcomer in this field. Begin with an exchange with a high reputation and accept the cryptocurrency you wish to trade.

Related Reading: Check out our guide on how to choose the right blockchain.