The Leader in Next-Generation Lithium-Ion Enovix Corporation (NASDAQ: ENVX) The only company with a battery technology solution that offers significantly higher energy density, m… As the need for higher performance batteries continues to increase in devices such as smart phones, wearables, laptops, electric vehicles and AI based products, Enovix anticipates becoming a significant supplier to OEM partners globally.

Table of Contents

About the Company: Enovix Corporation

Enovix Corporation is a Silicon Valley company creating the next generation of lithium-ion batteries. Enovix, which is focused on innovation at the heart of advanced lithium-ion battery development, is working to power next generation mobile devices, wearables and electric cars.

Quick Company Facts:

Medallia’s headquarters in California, United States, comprises 570 employees according to the annual report of 2024. The present organization head of Routejade Inc.

As Enovix expands its workforce, the company’s cunning and seasoned board is also proving to be an asset.

Enovix Stock Overview

| Metric | Details |

| Ticker Symbol | ENVX |

| Exchange | NASDAQ |

| Industry | Electrical Equipment & Parts |

| Sector | Industrials |

| Current Price | Shown above (live price) |

| 52-Week Range | ~ $5.27 – $16.49 |

| Market Cap | ~ $1.65B – $1.98B range reported |

| EPS (ttm) | Negative (~ -0.7 to -0.83) |

| Dividend | None |

| Analyst Sentiment | Strong Buy (price target around $17.14) |

Note: Enovix is an emerging battery tech company with volatile stock price movement; the range above reflects recent fluctuations.

What Drives the Stock?

Technology & Market Potential

- Enovix designs advanced silicon-anode lithium-ion batteries for wearables, IoT, smartphones, EVs, and more.

Capital Activity

- The public offering of equity shares and the convertible note offering (e.g. $300M senior notes).

Financial Growth

- Although the company is increasing output and is not yet profitable, its finances show strong revenue growth.

Volatility

- The past price behaviour of ENVX could be related to the growth expectation, tech execution risk & investor sentiment. Technical metrics such as Relative Strength Ratings have at times signaled stronger performance momentum.

Enovix Corporation (ENVX) Stock Price, News, Quote

ENVX is the stock symbol for Enovix Corporation, a leader in designing and manufacturing the next generation of lithium-ion batteries. Just know that as of recent updates, ENVX stock price is more oscillating but long-term investors still like the tech behind this one.

Key Stock Highlights:

- NASDAQ symbol: ENVX

- Industry: Battery tech & energy storage

- Notable for its Silicon-Anode Lithium-Ion Battery architecture

- Attracts retail and institutional investors

The market frequently covers ENVX stock news with developments related to tech innovation, government contracts, and production scaling. Keep an eye on ENVX for the latest movements.

What Does the ENVX Company Do?

So, what exactly is Enovix Corporation all about? ENVX designs and produces next-gen batteries for wearables, smartphones, AR devices, and even electric vehicles.

What Sets ENVX Apart:

- Uses silicon instead of graphite for battery anodes

- Delivers higher energy density and safety

- Targets markets like consumer electronics, defense, and EVs

- Invests heavily in R&D and mass production

The company’s tech promises batteries that charge faster and last longer, giving it an edge in a market demanding smarter energy solutions.

Financials

Let’s talk numbers. Enovix has been actively growing and investing in infrastructure, which is reflected in its financial performance.

Quarterly Financials (USD) – December 2024:

| Metric | Value | Y/Y Growth |

| Revenue | $9.717M | 31.65% |

| Net Income | -$37.5M | 37.53% |

| Diluted EPS | -0.20 | 45.95% |

| Net Profit Margin | -385.56% | 52.55% |

Earnings Calls:

| Quarter | EPS Beat | Revenue Beat |

| Dec 2024 | Beat by 38.89% | Beat by 10.79% |

Despite negative net income, the significant EPS and revenue beats are positive signs that the company is exceeding expectations as it scales.

Is ENVX a Good Investment?

Investors ask this all the time: is ENVX a buy? It depends on your risk appetite and how bullish you are on battery tech.

Why ENVX Might Be Worth It:

- Disruptive battery technology

- Strong R&D pipeline

- Partnerships with OEMs and government agencies

- Positioned in a growing $100B+ battery market

However, ENVX is still scaling production and hasn’t posted consistent profits. If you’re into long-term growth, ENVX could be a solid speculative play.

Who Is Invested in Enovix?

Curious about who’s backing envx? Several institutional investors and hedge funds have put their money into Enovix.

Major Investors Include:

- BlackRock

- Vanguard Group

- State Street Corporation

- Various tech-focused investment firms

Retail investors also show strong interest in ENVX thanks to its potential to disrupt energy storage. The investor profile shows confidence in the company’s tech and roadmap.

Does Enovix Have a Future?

Let’s be real—ENVX has a future if it executes on promises. The battery industry is booming, and Enovix is betting big on its tech.

Why the Future Looks Bright:

- Growing need for high-performance batteries

- Partnerships with government and defense sectors

- Rising demand from EV and mobile markets

- Ongoing expansion of production facilities

The question isn’t if ENVX has a future—it’s whether it can scale fast enough to lead the charge.

Enovix vs. The Competition: Who Leads the Advanced Battery Race?

Here’s a side-by-side comparison showing how Enovix stacks up against key competitors in the advanced battery and silicon anode technology race:

Company |

Core Technology Focus |

Key Strengths |

Current Stage / Market Focus |

Notes on Competitive Position |

| Enovix | 3D silicon-anode lithium-ion | High volumetric energy density; patented architecture; strong performance in compact devices | Consumer electronics (smartphones, wearables), IoT, AR/VR; scaling manufacturing | Independent testing shows some of the highest energy density smartphone batteries reported (~919 Wh/L) and fast charging; still scaling production & competing against larger incumbents. |

| Amprius Technologies | Silicon nanowire anodes | Very high gravimetric and volumetric energy performance; strong fast-charge specs | Aerospace, EVs, industrial markets | Often cited as leader in silicon anode energy density; broader application range (e.g., aviation, EV) but different markets than Enovix. |

| Sila Nanotechnologies | Silicon-enhanced anode materials | Large funding; partnerships (e.g., with Mercedes-Benz, Panasonic) | EV and consumer electronics materials supply | Focuses on silicon powder anode materials used by partners rather than finished cells; strong ecosystem support. |

| Enevate | Silicon-dominant anode tech | Ultra-fast charging capability | Consumer EV and electronics | Known for fast-charging silicon anodes and OEM collaborations. |

| Group14 Technologies | Silicon-carbon composite anodes | Strong material platform; scalable partnerships | Battery OEMs & material suppliers | Focuses on enabling silicon anode integration across manufacturers; not direct cell maker like Enovix. |

| Major Incumbents (CATL, LG Energy Solution, Panasonic) | Traditional Li-ion & incremental silicon doping | Massive scale, established supply chains | EVs, energy storage, consumer electronics | Huge production and resources; gradually integrating silicon improvements but not fully silicon anode yet. |

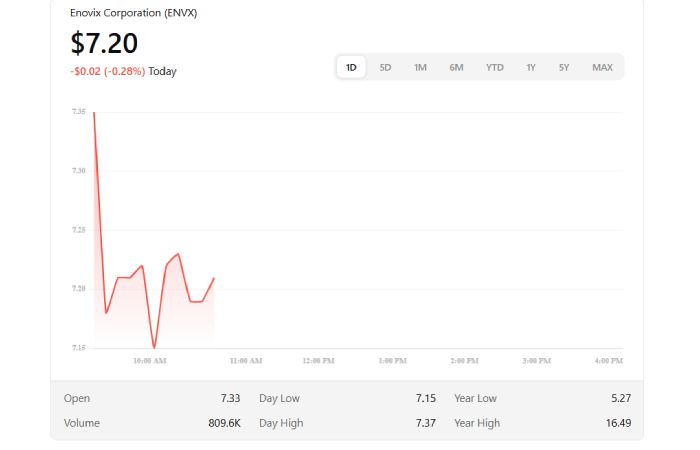

Enovix Corp (ENVX) Stock Price & News

The ENVX stock price is influenced by tech rollouts, quarterly earnings, and news around contracts or partnerships.

| Category | Details & Latest Info |

| Ticker | ENVX (Enovix Corporation) |

| Current Price | $7.20 per share (as of latest market update on Jan 28, 2026) |

| Intraday Range | $7.15 – $7.37 |

| Market | NASDAQ, United States |

| Recent Price Trend | Slight intraday dip but generally trading under long-term highs (52-week range ~$5.27 – $16.49) |

| 52-Week Performance | Lower than previous peak levels with volatility tied to company catalysts and guidance changes |

| Technical Signals | RS rating improvements suggest periods of relative strength compared with peers (80+ ratings) |

| Recent Positive News | Completed $96 M equity offering, strengthening cash position for 2025 production plans |

| Battery | Smartphone battery development milestone achieved and ISO 9001 certification earned at Malaysia facility |

| Operational News | Leadership transition as company prepares for production scale-up for smartphones and other tech devices |

| Financial Highlights | Q2 2025 preliminary results exceeded revenue guidance, showing growth trends |

| Shareholder Actions | Warrants distribution provided potential upside and shareholder value tools |

| Recent Challenges | Mixed market reactions and volatility following earnings and growth guidance |

| Analyst Context | Forecasts and target prices vary widely, reflecting both growth potential and execution risks |

ENOVIX CORP Share Price, ENVX Stock Price Quote Today

You can check the ENVX stock quote today on financial platforms like Yahoo Finance, Google Finance, or NASDAQ.

ENVX Stock Price:

| Date | Open | High | Low | Close |

| April 1 | $12.05 | $12.45 | $11.87 | $12.30 |

| April 2 | $12.30 | $12.85 | $12.10 | $12.70 |

These numbers change daily based on news and market sentiment. Tracking ENVX stock price live helps in making smart trading decisions.

Enovix Corporation Common Stock (ENVX)

Enovix Corporation Common Stock (NASDAQ: ENVX)

| Category | Details |

| Company Name | Enovix Corporation |

| Ticker Symbol | ENVX |

| Exchange | NASDAQ (U.S.) |

| Current Price | $7.14 per share (latest market data) |

| Intraday Range | $7.135 – $7.37 |

| Previous Close | ~$7.22 |

| Market Cap | ~$1.6 – 1.7 B (approx.) |

| 52-Week Range | $5.27 – $16.49 |

| Beta (Volatility) | ~2.1 (higher than average) |

| EPS (ttm) | -0.83 (loss per share) |

| Revenue (ttm) | ~$30 M (approx.) |

| Net Income (ttm) | ~ -$159 M (loss) |

| Analyst Consensus | Strong Buy (12-mo avg. target ~ $17.14) |

| Next Earnings Date | Feb 18, 2026 (est) |

| Industry | Electrical Equipment & Parts (Advanced Batteries) |

| Headquarters | Fremont, California, USA |

| Founded | 2006 (technology/energy sector) |

Recent Company & Stock News Highlights

| Event / News | Impact |

| Leadership transition to support manufacturing scale-up | Signals operational focus on growth and execution |

| Enovix AI-1 battery achieves high energy density benchmarks | Positive technology validation news |

| Completion of warrant dividend program (~$232M raised) | Strengthens cash position for production scale-up |

| Q4 2024 revenue growth + record results | Sequential revenue gains and manufacturing milestones |

Envx Stock Price Target

Analyst price targets give a rough idea of where ENVX could head.

Recent Analyst Forecasts:

- High Target: $28.00

- Average Target: $19.50

- Low Target: $12.00

These are based on projections related to production scale, new deals, and financial performance. Price targets aren’t guarantees—but they’re good indicators.

Comparisons or Alternatives of Enovix (ENVX)

Company |

Core Focus / Product |

Best For |

Business Model / Price Context |

User / Market Notes |

| Enovix Corporation (ENVX) | Advanced silicon-anode lithium-ion batteries | Compact high density batteries for phones, wearables, IoT | Public company; stock trades on NASDAQ; production ramping (ENVX) | Innovative silicon anode, strong performance claims (935 Wh/L) but early revenue stage |

| Group14 Technologies | Silicon-carbon composite battery materials | Silicon materials for enhanced battery performance | Private supplier of advanced battery materials | Partners with many OEMs; materials used globally for improved energy density |

| QuantumScape (QS) | Solid-state battery technology | Next-gen EV battery with high energy density potential | Public company; stock market investment possible | Considered a leader in solid-state tech, large EV focus |

| Addionics | 3D architectural battery components | Improved energy, safety and charging | Private advanced battery tech developer | Based in UK; focuses on next-gen cell designs |

| Sila Nanotechnologies (Sila) | Nano-composite silicon anodes | Higher energy and faster charging | Private; partners with device makers | Alternative anode tech improving battery capacity |

| Ecellix | High-capacity silicon anode materials | Battery materials R&D | Private specialist | Works on silicon-based materials that rival traditional anodes |

| Tesla, Inc. (TSLA) | EV and energy storage batteries | Scalable battery gigafactory production | Public; battery cells are part of broader EV business | Massive production scale; strong cost advantages |

| Panasonic Holdings | Automotive & consumer electronics batteries | Long-established supplier for EVs | Public; large revenue base | Major battery supplier with global presence |

| Samsung SDI | Wide range of advanced batteries | Consumer and EV power systems | Public; diversified product lines | Global player with deep R&D |

| CATL (Contemporary Amperex) | Large-scale lithium & sodium battery manufacturing | EV and energy storage systems | Public; one of the world’s largest battery makers | Dominates battery production, especially in China |

| Factorial Energy | Solid-state electrolyte tech | Safer solid-state batteries | Private innovator | Solid-state approach like some QuantumScape rivals |

| ProLogium | Solid-state battery manufacturer | Automotive and consumer solid-state cells | Private (Taiwan) | A leader in solid-state battery tech globally |

Real-World Applications: Where You’ll See Enovix Batteries

Enovix’s batteries are designed not just for smartphones, but a wide array of devices:

Smartphones & Wearables

The energy density is high and the charging speed is fast, which makes Enovix cells suitable for next-gen mobile smartphones with AI functions, always-on connectivity, and high refresh screens. Wearables and IoT devices get to smaller form factors with better battery life for all-day wear, without increasing device size.

Laptops & Tablets

High-density silicon batteries could transform mobile computing by the length of time that a device may be used unplugged and by the intensity of the workloads it can carry.

Electric Vehicles & Industrial

Although still early in EV applications, Enovix’s scalable architecture and thermal safety promise potential future adoption in electric mobility and industrial power solutions.

Mixed Reality & Emerging Tech

Enovix also has contracts to supply batteries for roomscale mixed reality headsets — which are lightweight and high energy density products needed to deliver immersive experiences. This serves to underscore momentum into next generation hardware beyond smartphones.

Recent Commercial Progress & OEM Partnerships

Milestone / Partnership |

Description |

Impact / Notes |

Leading Smartphone OEM Development Agreements |

Enovix executed development agreements with multiple leading smartphone OEMs, including two of the world’s top OEMs for customized 100% active silicon anode batteries. | Lays foundation for mass production and commercial smartphone battery launches by late 2025. |

Completion of ISO 9001:2015 Certification & Samples Delivery |

Achieved ISO certification for Fab2 (Malaysia) and shipped sample battery cells meeting custom specifications to a major smartphone OEM. | Validation of manufacturing quality and customer-ready product development. |

Shipped EX-2M Battery Samples & Received First Purchase Order |

Second-gen EX-2M battery samples shipped from Malaysia; first mobile phone customer purchase order received. | Strong commercial validation and early revenue signals ahead of mass production. |

AI-1™ Battery Platform Launch & Sampling to Smartphone OEM |

Launched AI-1 silicon-anode battery platform, with first 7,350 mAh high-energy samples delivered to a leading smartphone OEM for qualification. | Positions Enovix as supplier of high-density batteries tailored for AI-driven devices. |

Progress on 2025 Smartphone Launch Milestone |

Completion of a second milestone triggered by battery samples meeting OEM development agreement criteria. | Positive validation from customers; continued movement toward commercial launch. |

Ongoing Sampling with Multiple OEMs & Industries |

Continued sampling of battery cells to other top mobile OEMs, delivery of smart eyewear battery packs, and manufacturing optimizations. | Widens OEM engagement across mobile, IoT, and industrial markets — supports diversified commercialization. |

Collaboration with Fortune 200 Company (IoT) |

Signed a collaboration agreement to develop silicon batteries for a major IoT product category. | Access to a large IoT market with potential volume production and milestone payments. |

MOU with Elentec for Battery Pack Production |

Memorandum of Understanding with Elentec Co., Ltd. to enhance battery pack design and production capabilities. | Strengthens Enovix’s supply/value chain and capability to support consumer electronics, industrial, and military sectors. |

ISO & Manufacturing Readiness (Fab2) |

Site Acceptance Testing completed for Fab2 high-volume production line; formal ISO certification achieved. | Manufacturing readiness essential for scaling up production for OEM partners. |

Final Thoughts on ENVX

The hype around envx isn’t just noise. Enovix Corporation is legit pushing boundaries in battery tech. Supported by huge names and close promises of product innovation, ENVX is surely a 2025 watch stock. and beyond. As always, do your own research before investing. The future of energy storage might just have ENVX written all over it.

Keep an eye on envx if you believe in smarter, faster, and safer batteries. It could be the game-changer your portfolio needs.